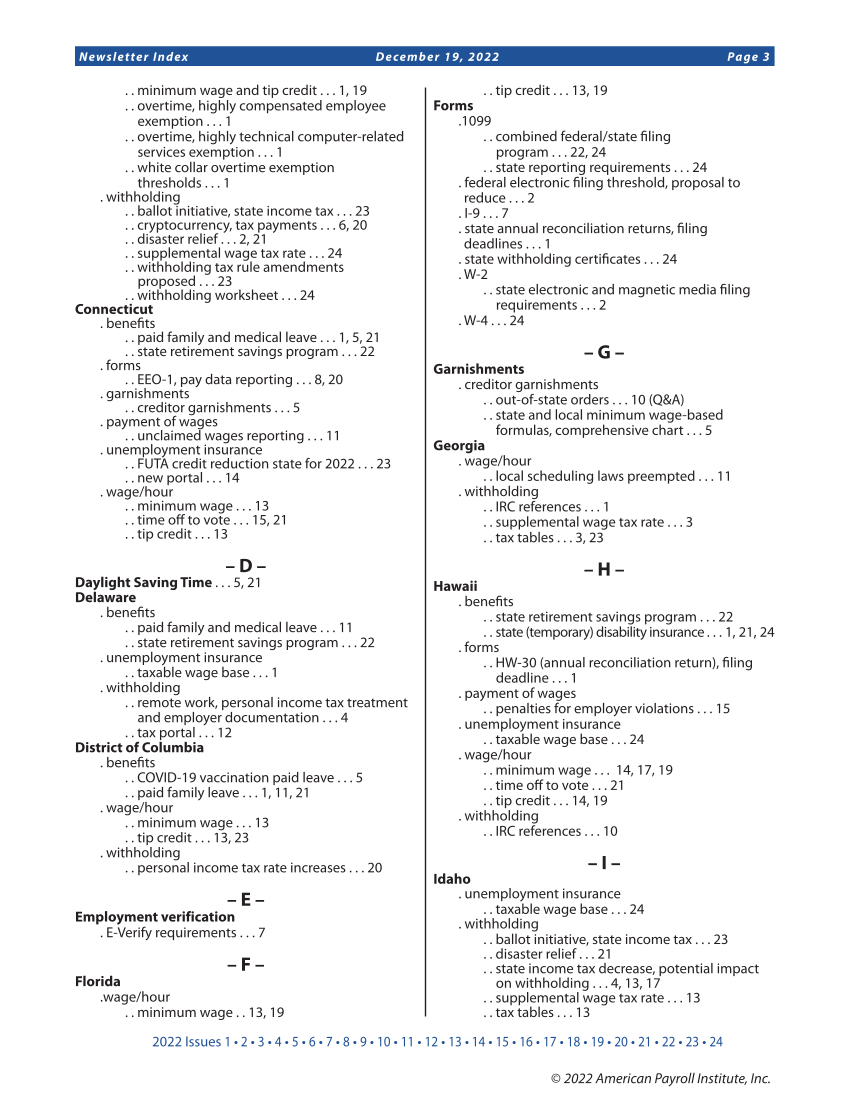

2022 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 19, 2022 Page 3 © 2022 American Payroll Institute, Inc. . . minimum wage and tip credit . . . 1, 19 . . overtime, highly compensated employee exemption . . . 1 . . overtime, highly technical computer-related services exemption . . . 1 . . white collar overtime exemption thresholds . . . 1 . withholding . . ballot initiative, state income tax . . . 23 . . cryptocurrency, tax payments . . . 6, 20 . . disaster relief . . . 2, 21 . . supplemental wage tax rate . . . 24 . . withholding tax rule amendments proposed . . . 23 . . withholding worksheet . . . 24 Connecticut . benefits . . paid family and medical leave . . . 1, 5, 21 . . state retirement savings program . . . 22 . forms . . EEO-1, pay data reporting . . . 8, 20 . garnishments . . creditor garnishments . . . 5 . payment of wages . . unclaimed wages reporting . . . 11 . unemployment insurance . . FUTA credit reduction state for 2022 . . . 23 . . new portal . . . 14 . wage/hour . . minimum wage . . . 13 . . time off to vote . . . 15, 21 . . tip credit . . . 13 – D – Daylight Saving Time . . . 5, 21 Delaware . benefits . . paid family and medical leave . . . 11 . . state retirement savings program . . . 22 . unemployment insurance . . taxable wage base . . . 1 . withholding . . remote work, personal income tax treatment and employer documentation . . . 4 . . tax portal . . . 12 District of Columbia . benefits . . COVID-19 vaccination paid leave . . . 5 . . paid family leave . . . 1, 11, 21 . wage/hour . . minimum wage . . . 13 . . tip credit . . . 13, 23 . withholding . . personal income tax rate increases . . . 20 – E – Employment verification . E-Verify requirements . . . 7 – F – Florida .wage/hour . . minimum wage . . 13, 19 . . tip credit . . . 13, 19 Forms .1099 . . combined federal/state filing program . . . 22, 24 . . state reporting requirements . . . 24 . federal electronic filing threshold, proposal to reduce . . . 2 . I-9 . . . 7 . state annual reconciliation returns, filing deadlines . . . 1 . state withholding certificates . . . 24 . W-2 . . state electronic and magnetic media filing requirements . . . 2 . W-4 . . . 24 – G – Garnishments . creditor garnishments . . out-of-state orders . . . 10 (Q&A) . . state and local minimum wage-based formulas, comprehensive chart . . . 5 Georgia . wage/hour . . local scheduling laws preempted . . . 11 . withholding . . IRC references . . . 1 . . supplemental wage tax rate . . . 3 . . tax tables . . . 3, 23 – H – Hawaii . benefits . . state retirement savings program . . . 22 . . state (temporary) disability insurance . . . 1, 21, 24 . forms . . HW-30 (annual reconciliation return), filing deadline . . . 1 . payment of wages . . penalties for employer violations . . . 15 . unemployment insurance . . taxable wage base . . . 24 . wage/hour . . minimum wage . . . 14, 17, 19 . . time off to vote . . . 21 . . tip credit . . . 14, 19 . withholding . . IRC references . . . 10 – I – Idaho . unemployment insurance . . taxable wage base . . . 24 . withholding . . ballot initiative, state income tax . . . 23 . . disaster relief . . . 21 . . state income tax decrease, potential impact on withholding . . . 4, 13, 17 . . supplemental wage tax rate . . . 13 . . tax tables . . . 13

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)