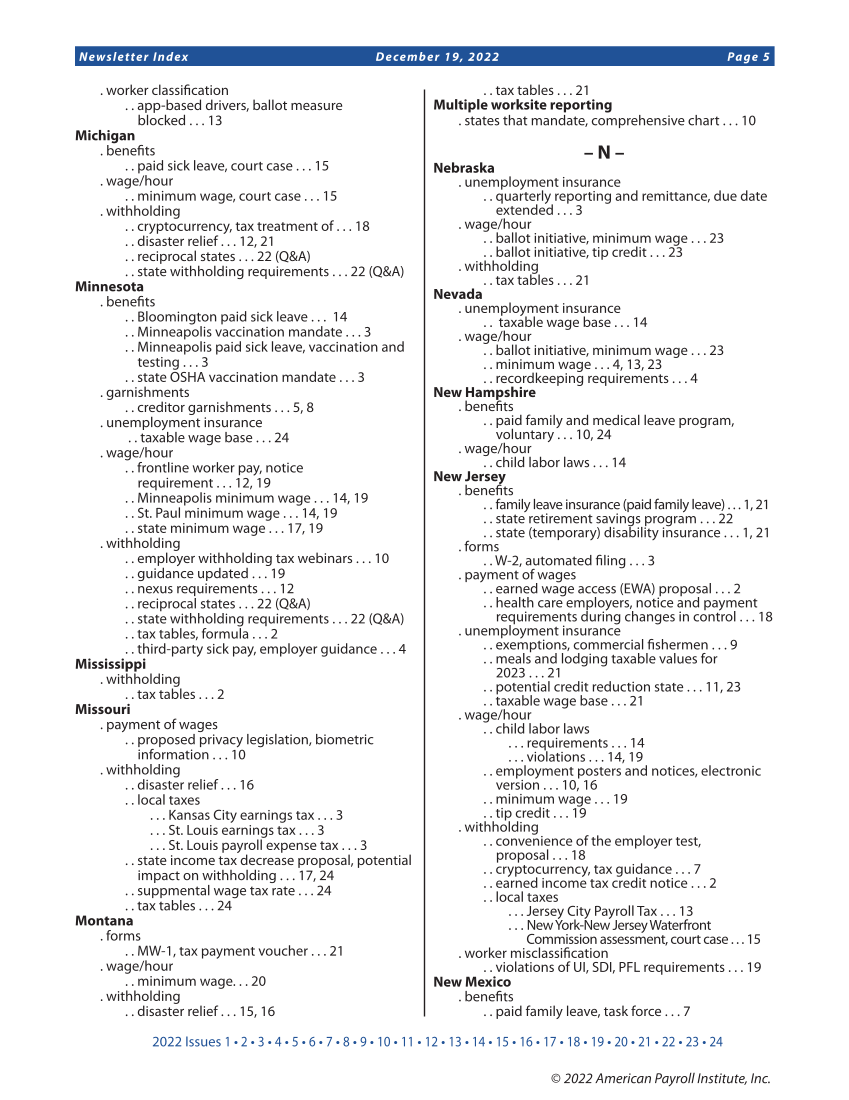

2022 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 19, 2022 Page 5 © 2022 American Payroll Institute, Inc. . worker classification . . app-based drivers, ballot measure blocked . . . 13 Michigan . benefits . . paid sick leave, court case . . . 15 . wage/hour . . minimum wage, court case . . . 15 . withholding . . cryptocurrency, tax treatment of . . . 18 . . disaster relief . . . 12, 21 . . reciprocal states . . . 22 (Q&A) . . state withholding requirements . . . 22 (Q&A) Minnesota . benefits . . Bloomington paid sick leave . . . 14 . . Minneapolis vaccination mandate . . . 3 . . Minneapolis paid sick leave, vaccination and testing . . . 3 . . state OSHA vaccination mandate . . . 3 . garnishments . . creditor garnishments . . . 5, 8 . unemployment insurance . . taxable wage base . . . 24 . wage/hour . . frontline worker pay, notice requirement . . . 12, 19 . . Minneapolis minimum wage . . . 14, 19 . . St. Paul minimum wage . . . 14, 19 . . state minimum wage . . . 17, 19 . withholding . . employer withholding tax webinars . . . 10 . . guidance updated . . . 19 . . nexus requirements . . . 12 . . reciprocal states . . . 22 (Q&A) . . state withholding requirements . . . 22 (Q&A) . . tax tables, formula . . . 2 . . third-party sick pay, employer guidance . . . 4 Mississippi . withholding . . tax tables . . . 2 Missouri . payment of wages . . proposed privacy legislation, biometric information . . . 10 . withholding . . disaster relief . . . 16 . . local taxes . . . Kansas City earnings tax . . . 3 . . . St. Louis earnings tax . . . 3 . . . St. Louis payroll expense tax . . . 3 . . state income tax decrease proposal, potential impact on withholding . . . 17, 24 . . suppmental wage tax rate . . . 24 . . tax tables . . . 24 Montana . forms . . MW-1, tax payment voucher . . . 21 . wage/hour . . minimum wage. . . 20 . withholding . . disaster relief . . . 15, 16 . . tax tables . . . 21 Multiple worksite reporting . states that mandate, comprehensive chart . . . 10 – N – Nebraska . unemployment insurance . . quarterly reporting and remittance, due date extended . . . 3 . wage/hour . . ballot initiative, minimum wage . . . 23 . . ballot initiative, tip credit . . . 23 . withholding . . tax tables . . . 21 Nevada . unemployment insurance . . taxable wage base . . . 14 . wage/hour . . ballot initiative, minimum wage . . . 23 . . minimum wage . . . 4, 13, 23 . . recordkeeping requirements . . . 4 New Hampshire . benefits . . paid family and medical leave program, voluntary . . . 10, 24 . wage/hour . . child labor laws . . . 14 New Jersey . benefits . . family leave insurance (paid family leave) . . . 1, 21 . . state retirement savings program . . . 22 . . state (temporary) disability insurance . . . 1, 21 . forms . . W-2, automated filing . . . 3 . payment of wages . . earned wage access (EWA) proposal . . . 2 . . health care employers, notice and payment requirements during changes in control . . . 18 . unemployment insurance . . exemptions, commercial fishermen . . . 9 . . meals and lodging taxable values for 2023 . . . 21 . . potential credit reduction state . . . 11, 23 . . taxable wage base . . . 21 . wage/hour . . child labor laws . . . requirements . . . 14 . . . violations . . . 14, 19 . . employment posters and notices, electronic version . . . 10, 16 . . minimum wage . . . 19 . . tip credit . . . 19 . withholding . . convenience of the employer test, proposal . . . 18 . . cryptocurrency, tax guidance . . . 7 . . earned income tax credit notice . . . 2 . . local taxes . . . Jersey City Payroll Tax . . . 13 . . . New York-New Jersey Waterfront Commission assessment, court case . . . 15 . worker misclassification . . violations of UI, SDI, PFL requirements . . . 19 New Mexico . benefits . . paid family leave, task force . . . 7

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)