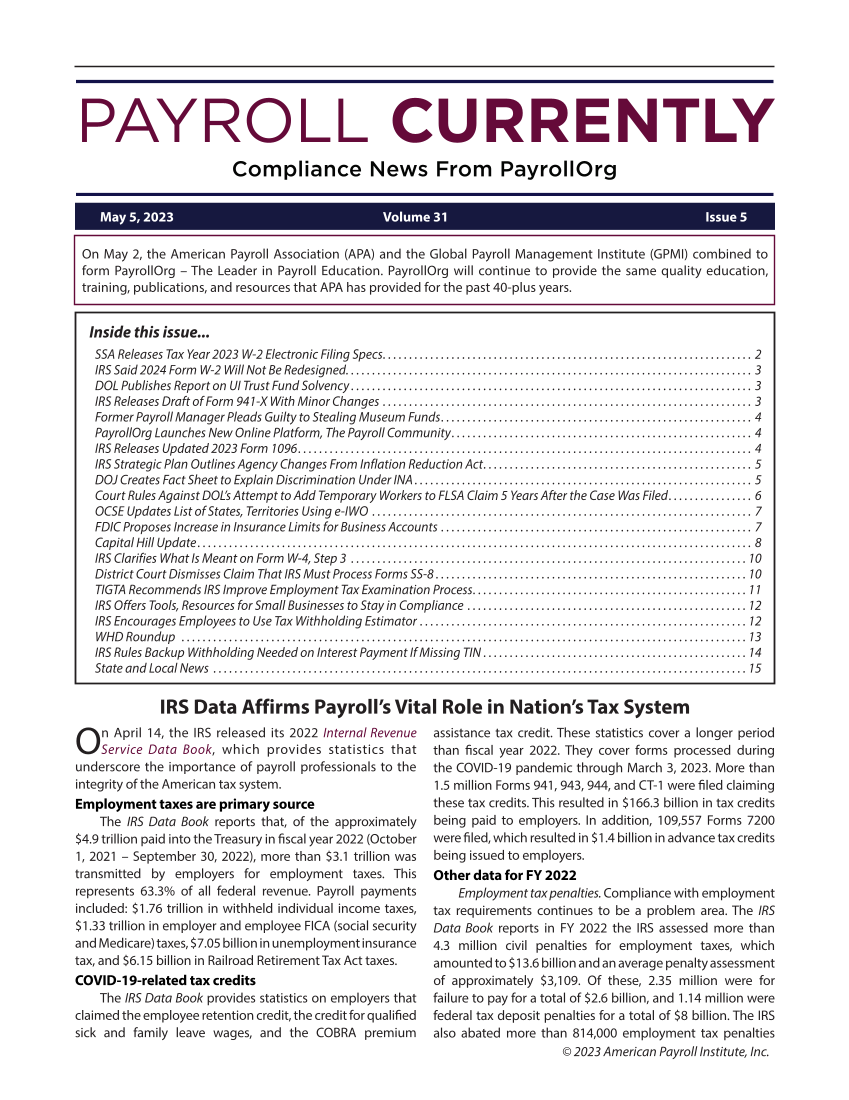

© 2023 American Payroll Institute, Inc. Inside this issue... SSA Releases Tax Year 2023 W-2 Electronic Filing Specs. .....................................................................2 IRS Said 2024 Form W-2 Will Not Be Redesigned. ............................................................................3 DOL Publishes Report on UI Trust Fund Solvency ............................................................................3 IRS Releases Draft of Form 941-X With Minor Changes. ......................................................................3 Former Payroll Manager Pleads Guilty to Stealing Museum Funds. ..........................................................4 PayrollOrg Launches New Online Platform, The Payroll Community. ........................................................4 IRS Releases Updated 2023 Form 1096. .....................................................................................4 IRS Strategic Plan Outlines Agency Changes From Inflation Reduction Act. ..................................................5 DOJ Creates Fact Sheet to Explain Discrimination Under INA ................................................................5 Court Rules Against DOL’s Attempt to Add Temporary Workers to FLSA Claim 5 Years After the Case Was Filed. ...............6 OCSE Updates List of States, Territories Using e-IWO. ........................................................................7 FDIC Proposes Increase in Insurance Limits for Business Accounts. ...........................................................7 Capital Hill Update .........................................................................................................8 IRS Clarifies What Is Meant on Form W-4, Step 3. ...........................................................................10 District Court Dismisses Claim That IRS Must Process Forms SS-8 ...........................................................10 TIGTA Recommends IRS Improve Employment Tax Examination Process. ...................................................11 IRS Offers Tools, Resources for Small Businesses to Stay in Compliance .....................................................12 IRS Encourages Employees to Use Tax Withholding Estimator. ..............................................................12 WHD Roundup ............................................................................................................13 IRS Rules Backup Withholding Needed on Interest Payment If Missing TIN. ..................................................14 State and Local News. .....................................................................................................15 May 5, 2023 Volume 31 Issue 5 IRS Data Affirms Payroll’s Vital Role in Nation’s Tax System On April 14, the IRS released its 2022 Internal Revenue Service Data Book, which provides statistics that underscore the importance of payroll professionals to the integrity of the American tax system. Employment taxes are primary source The IRS Data Book reports that, of the approximately $4.9 trillion paid into the Treasury in fiscal year 2022 (October 1, 2021 – September 30, 2022), more than $3.1 trillion was transmitted by employers for employment taxes. This represents 63.3% of all federal revenue. Payroll payments included: $1.76 trillion in withheld individual income taxes, $1.33 trillion in employer and employee FICA (social security and Medicare) taxes, $7.05 billion in unemployment insurance tax, and $6.15 billion in Railroad Retirement Tax Act taxes. COVID-19-related tax credits The IRS Data Book provides statistics on employers that claimed the employee retention credit, the credit for qualified sick and family leave wages, and the COBRA premium assistance tax credit. These statistics cover a longer period than fiscal year 2022. They cover forms processed during the COVID-19 pandemic through March 3, 2023. More than 1.5 million Forms 941, 943, 944, and CT-1 were filed claiming these tax credits. This resulted in $166.3 billion in tax credits being paid to employers. In addition, 109,557 Forms 7200 were filed, which resulted in $1.4 billion in advance tax credits being issued to employers. Other data for FY 2022 Employment tax penalties. Compliance with employment tax requirements continues to be a problem area. The IRS Data Book reports in FY 2022 the IRS assessed more than 4.3 million civil penalties for employment taxes, which amounted to $13.6 billion and an average penalty assessment of approximately $3,109. Of these, 2.35 million were for failure to pay for a total of $2.6 billion, and 1.14 million were federal tax deposit penalties for a total of $8 billion. The IRS also abated more than 814,000 employment tax penalties On May 2, the American Payroll Association (APA) and the Global Payroll Management Institute (GPMI) combined to form PayrollOrg – The Leader in Payroll Education. PayrollOrg will continue to provide the same quality education, training, publications, and resources that APA has provided for the past 40-plus years.

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)