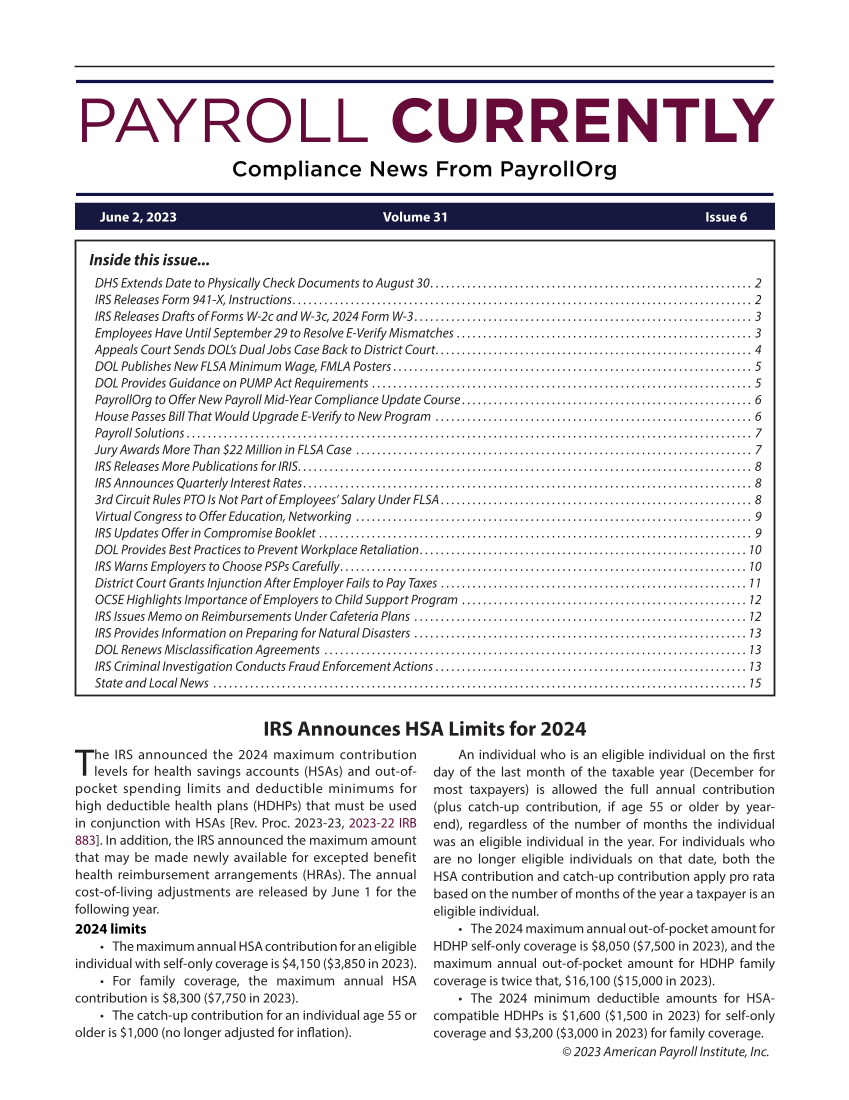

© 2023 American Payroll Institute, Inc. Inside this issue... DHS Extends Date to Physically Check Documents to August 30. ............................................................2 IRS Releases Form 941-X, Instructions. ......................................................................................2 IRS Releases Drafts of Forms W-2c and W-3c, 2024 Form W-3 ................................................................3 Employees Have Until September 29 to Resolve E-Verify Mismatches. ........................................................3 Appeals Court Sends DOL’s Dual Jobs Case Back to District Court. ...........................................................4 DOL Publishes New FLSA Minimum Wage, FMLA Posters ....................................................................5 DOL Provides Guidance on PUMP Act Requirements. ........................................................................5 PayrollOrg to Offer New Payroll Mid-Year Compliance Update Course .......................................................6 House Passes Bill That Would Upgrade E-Verify to New Program. ............................................................6 Payroll Solutions. ...........................................................................................................7 Jury Awards More Than $22 Million in FLSA Case. ...........................................................................7 IRS Releases More Publications for IRIS. .....................................................................................8 IRS Announces Quarterly Interest Rates .....................................................................................8 3rd Circuit Rules PTO Is Not Part of Employees’ Salary Under FLSA ...........................................................8 Virtual Congress to Offer Education, Networking. ...........................................................................9 IRS Updates Offer in Compromise Booklet. ..................................................................................9 DOL Provides Best Practices to Prevent Workplace Retaliation. .............................................................10 IRS Warns Employers to Choose PSPs Carefully. ............................................................................10 District Court Grants Injunction After Employer Fails to Pay Taxes. ..........................................................11 OCSE Highlights Importance of Employers to Child Support Program. ......................................................12 IRS Issues Memo on Reimbursements Under Cafeteria Plans. ...............................................................12 IRS Provides Information on Preparing for Natural Disasters. ...............................................................13 DOL Renews Misclassification Agreements. ................................................................................13 IRS Criminal Investigation Conducts Fraud Enforcement Actions ...........................................................13 State and Local News. .....................................................................................................15 June 2, 2023 Volume 31 Issue 6 IRS Announces HSA Limits for 2024 The IRS announced the 2024 maximum contribution levels for health savings accounts (HSAs) and out-of- pocket spending limits and deductible minimums for high deductible health plans (HDHPs) that must be used in conjunction with HSAs [Rev. Proc. 2023-23, 2023-22 IRB 883]. In addition, the IRS announced the maximum amount that may be made newly available for excepted benefit health reimbursement arrangements (HRAs). The annual cost-of-living adjustments are released by June 1 for the following year. 2024 limits • The maximum annual HSA contribution for an eligible individual with self-only coverage is $4,150 ($3,850 in 2023). • For family coverage, the maximum annual HSA contribution is $8,300 ($7,750 in 2023). • The catch-up contribution for an individual age 55 or older is $1,000 (no longer adjusted for inflation). An individual who is an eligible individual on the first day of the last month of the taxable year (December for most taxpayers) is allowed the full annual contribution (plus catch-up contribution, if age 55 or older by year- end), regardless of the number of months the individual was an eligible individual in the year. For individuals who are no longer eligible individuals on that date, both the HSA contribution and catch-up contribution apply pro rata based on the number of months of the year a taxpayer is an eligible individual. • The 2024 maximum annual out-of-pocket amount for HDHP self-only coverage is $8,050 ($7,500 in 2023), and the maximum annual out-of-pocket amount for HDHP family coverage is twice that, $16,100 ($15,000 in 2023). • The 2024 minimum deductible amounts for HSA- compatible HDHPs is $1,600 ($1,500 in 2023) for self-only coverage and $3,200 ($3,000 in 2023) for family coverage.

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)