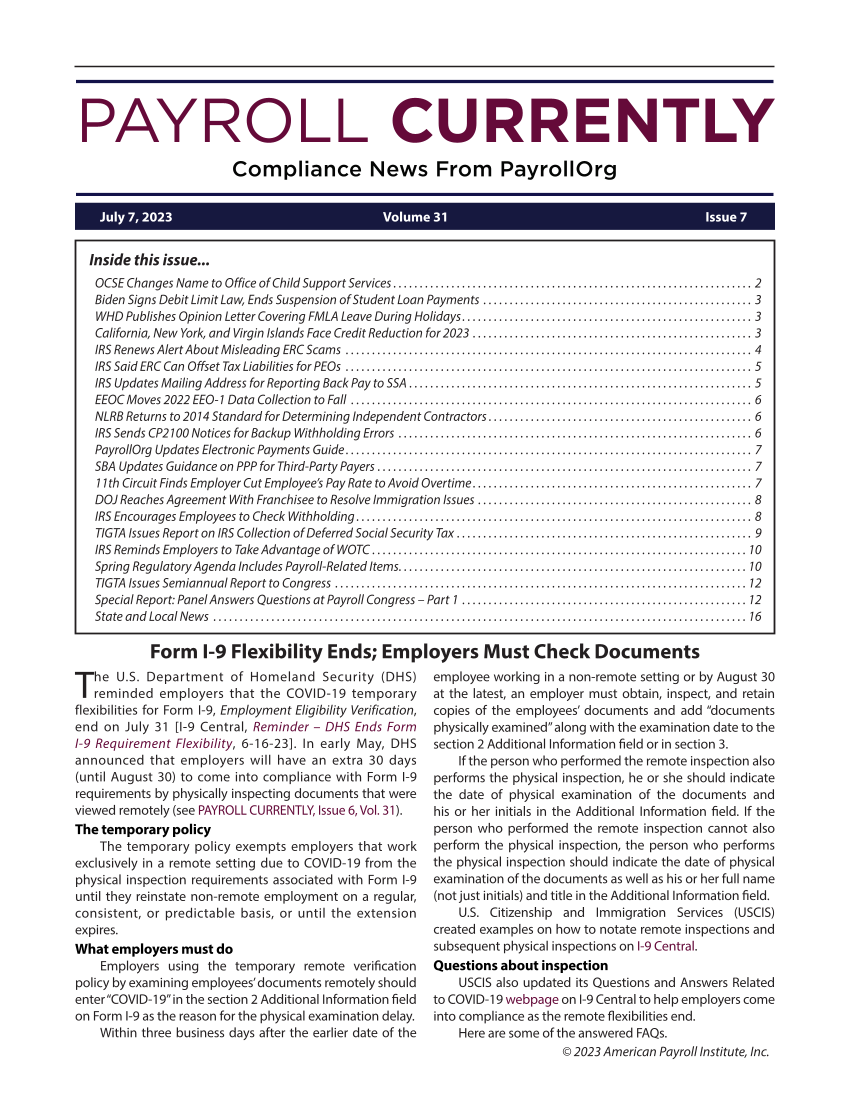

© 2023 American Payroll Institute, Inc. Inside this issue... OCSE Changes Name to Office of Child Support Services ....................................................................2 Biden Signs Debit Limit Law, Ends Suspension of Student Loan Payments. ...................................................3 WHD Publishes Opinion Letter Covering FMLA Leave During Holidays .......................................................3 California, New York, and Virgin Islands Face Credit Reduction for 2023. .....................................................3 IRS Renews Alert About Misleading ERC Scams. .............................................................................4 IRS Said ERC Can Offset Tax Liabilities for PEOs. .............................................................................5 IRS Updates Mailing Address for Reporting Back Pay to SSA. .................................................................5 EEOC Moves 2022 EEO-1 Data Collection to Fall. ............................................................................6 NLRB Returns to 2014 Standard for Determining Independent Contractors ..................................................6 IRS Sends CP2100 Notices for Backup Withholding Errors. ...................................................................6 PayrollOrg Updates Electronic Payments Guide .............................................................................7 SBA Updates Guidance on PPP for Third-Party Payers. .......................................................................7 11th Circuit Finds Employer Cut Employee’s Pay Rate to Avoid Overtime .....................................................7 DOJ Reaches Agreement With Franchisee to Resolve Immigration Issues. ....................................................8 IRS Encourages Employees to Check Withholding ...........................................................................8 TIGTA Issues Report on IRS Collection of Deferred Social Security Tax. ........................................................9 IRS Reminds Employers to Take Advantage of WOTC. .......................................................................10 Spring Regulatory Agenda Includes Payroll-Related Items. .................................................................10 TIGTA Issues Semiannual Report to Congress. ..............................................................................12 Special Report: Panel Answers Questions at Payroll Congress – Part 1 ......................................................12 State and Local News. .....................................................................................................16 July 7, 2023 Volume 31 Issue 7 Form I-9 Flexibility Ends Employers Must Check Documents The U.S. Department of Homeland Security (DHS) reminded employers that the COVID-19 temporary flexibilities for Form I-9, Employment Eligibility Verification, end on July 31 [I-9 Central, Reminder – DHS Ends Form I-9 Requirement Flexibility, 6-16-23]. In early May, DHS announced that employers will have an extra 30 days (until August 30) to come into compliance with Form I-9 requirements by physically inspecting documents that were viewed remotely (see PAYROLL CURRENTLY, Issue 6, Vol. 31). The temporary policy The temporary policy exempts employers that work exclusively in a remote setting due to COVID-19 from the physical inspection requirements associated with Form I-9 until they reinstate non-remote employment on a regular, consistent, or predictable basis, or until the extension expires. What employers must do Employers using the temporary remote verification policy by examining employees’ documents remotely should enter “COVID-19” in the section 2 Additional Information field on Form I-9 as the reason for the physical examination delay. Within three business days after the earlier date of the employee working in a non-remote setting or by August 30 at the latest, an employer must obtain, inspect, and retain copies of the employees’ documents and add “documents physically examined” along with the examination date to the section 2 Additional Information field or in section 3. If the person who performed the remote inspection also performs the physical inspection, he or she should indicate the date of physical examination of the documents and his or her initials in the Additional Information field. If the person who performed the remote inspection cannot also perform the physical inspection, the person who performs the physical inspection should indicate the date of physical examination of the documents as well as his or her full name (not just initials) and title in the Additional Information field. U.S. Citizenship and Immigration Services (USCIS) created examples on how to notate remote inspections and subsequent physical inspections on I-9 Central. Questions about inspection USCIS also updated its Questions and Answers Related to COVID-19 webpage on I-9 Central to help employers come into compliance as the remote flexibilities end. Here are some of the answered FAQs.

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)