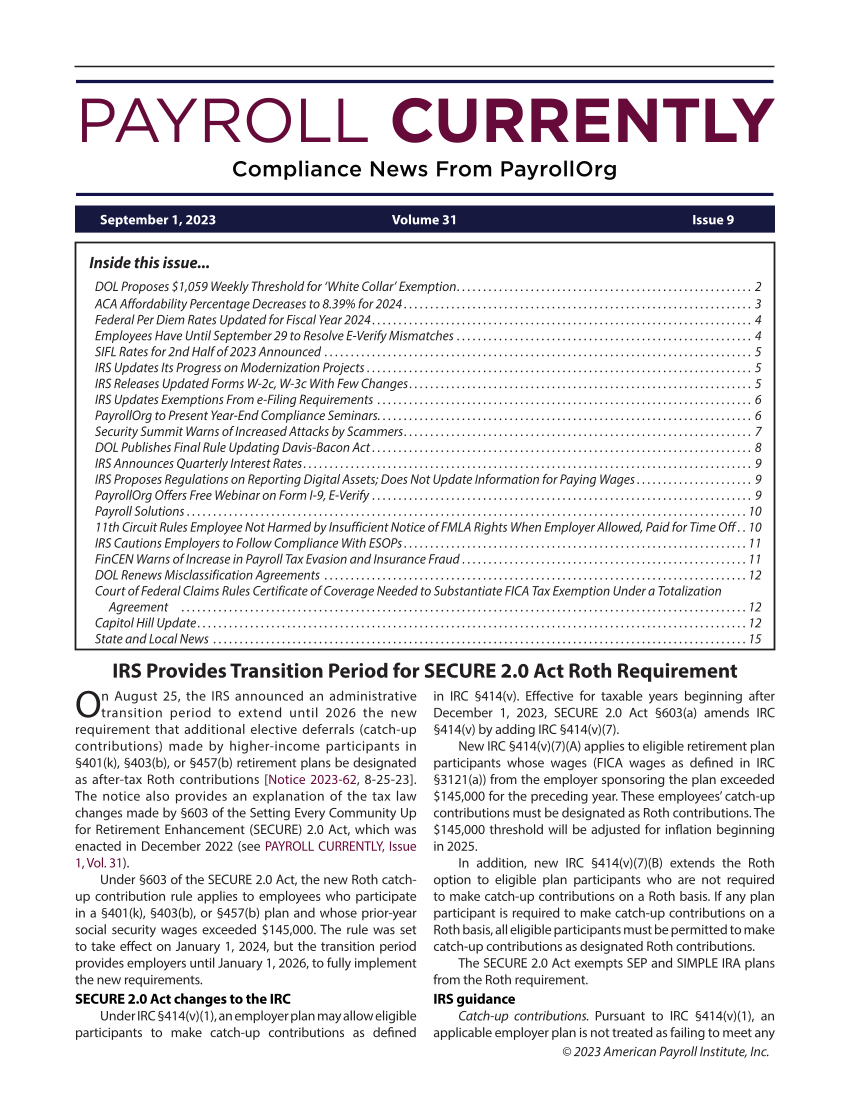

© 2023 American Payroll Institute, Inc. Inside this issue... DOL Proposes $1,059 Weekly Threshold for ‘White Collar’ Exemption. .......................................................2 ACA Affordability Percentage Decreases to 8.39% for 2024 ..................................................................3 Federal Per Diem Rates Updated for Fiscal Year 2024 ........................................................................4 Employees Have Until September 29 to Resolve E-Verify Mismatches. ........................................................4 SIFL Rates for 2nd Half of 2023 Announced. .................................................................................5 IRS Updates Its Progress on Modernization Projects. .........................................................................5 IRS Releases Updated Forms W-2c, W-3c With Few Changes .................................................................5 IRS Updates Exemptions From e-Filing Requirements. .......................................................................6 PayrollOrg to Present Year-End Compliance Seminars. ......................................................................6 Security Summit Warns of Increased Attacks by Scammers. .................................................................7 DOL Publishes Final Rule Updating Davis-Bacon Act ........................................................................8 IRS Announces Quarterly Interest Rates .....................................................................................9 IRS Proposes Regulations on Reporting Digital Assets Does Not Update Information for Paying Wages ......................9 PayrollOrg Offers Free Webinar on Form I-9, E-Verify ........................................................................9 Payroll Solutions. ..........................................................................................................10 11th Circuit Rules Employee Not Harmed by Insufficient Notice of FMLA Rights When Employer Allowed, Paid for Time Off. ..10 IRS Cautions Employers to Follow Compliance With ESOPs .................................................................11 FinCEN Warns of Increase in Payroll Tax Evasion and Insurance Fraud. ......................................................11 DOL Renews Misclassification Agreements. ................................................................................12 Court of Federal Claims Rules Certificate of Coverage Needed to Substantiate FICA Tax Exemption Under a Totalization Agreement ............................................................................................................12 Capitol Hill Update ........................................................................................................12 State and Local News. .....................................................................................................15 September 1, 2023 Volume 31 Issue 9 IRS Provides Transition Period for SECURE 2.0 Act Roth Requirement On August 25, the IRS announced an administrative transition period to extend until 2026 the new requirement that additional elective deferrals (catch-up contributions) made by higher-income participants in §401(k), §403(b), or §457(b) retirement plans be designated as after-tax Roth contributions [Notice 2023-62, 8-25-23]. The notice also provides an explanation of the tax law changes made by §603 of the Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act, which was enacted in December 2022 (see PAYROLL CURRENTLY, Issue 1, Vol. 31). Under §603 of the SECURE 2.0 Act, the new Roth catch- up contribution rule applies to employees who participate in a §401(k), §403(b), or §457(b) plan and whose prior-year social security wages exceeded $145,000. The rule was set to take effect on January 1, 2024, but the transition period provides employers until January 1, 2026, to fully implement the new requirements. SECURE 2.0 Act changes to the IRC Under IRC §414(v)(1), an employer plan may allow eligible participants to make catch-up contributions as defined in IRC §414(v). Effective for taxable years beginning after December 1, 2023, SECURE 2.0 Act §603(a) amends IRC §414(v) by adding IRC §414(v)(7). New IRC §414(v)(7)(A) applies to eligible retirement plan participants whose wages (FICA wages as defined in IRC §3121(a)) from the employer sponsoring the plan exceeded $145,000 for the preceding year. These employees’ catch-up contributions must be designated as Roth contributions. The $145,000 threshold will be adjusted for inflation beginning in 2025. In addition, new IRC §414(v)(7)(B) extends the Roth option to eligible plan participants who are not required to make catch-up contributions on a Roth basis. If any plan participant is required to make catch-up contributions on a Roth basis, all eligible participants must be permitted to make catch-up contributions as designated Roth contributions. The SECURE 2.0 Act exempts SEP and SIMPLE IRA plans from the Roth requirement. IRS guidance Catch-up contributions. Pursuant to IRC §414(v)(1), an applicable employer plan is not treated as failing to meet any

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)