© 2023 American Payroll Institute, Inc.

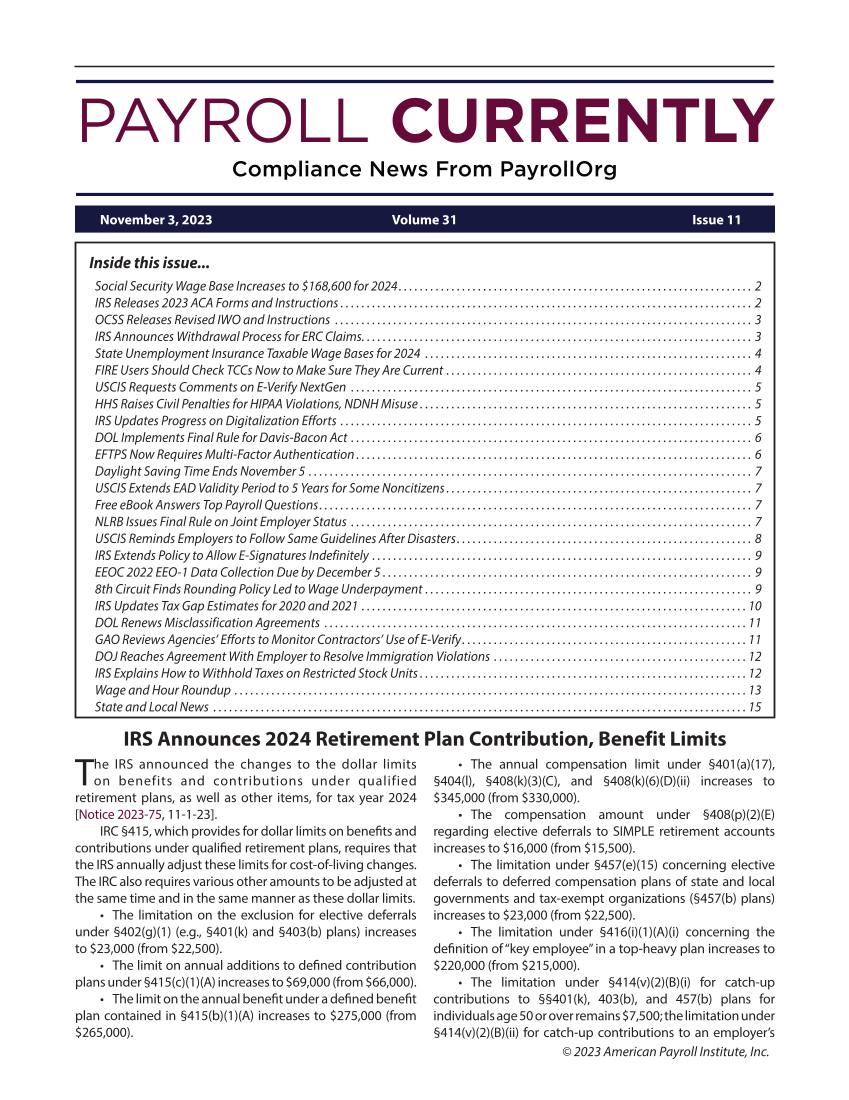

Inside this issue...

Social Security Wage Base Increases to $168,600 for 2024 ...................................................................2

IRS Releases 2023 ACA Forms and Instructions ..............................................................................2

OCSS Releases Revised IWO and Instructions. ...............................................................................3

IRS Announces Withdrawal Process for ERC Claims. .........................................................................3

State Unemployment Insurance Taxable Wage Bases for 2024. ..............................................................4

FIRE Users Should Check TCCs Now to Make Sure They Are Current. ..........................................................4

USCIS Requests Comments on E-Verify NextGen. ............................................................................5

HHS Raises Civil Penalties for HIPAA Violations, NDNH Misuse ...............................................................5

IRS Updates Progress on Digitalization Efforts. ..............................................................................5

DOL Implements Final Rule for Davis-Bacon Act. ............................................................................6

EFTPS Now Requires Multi-Factor Authentication ...........................................................................6

Daylight Saving Time Ends November 5. ....................................................................................7

USCIS Extends EAD Validity Period to 5 Years for Some Noncitizens ..........................................................7

Free eBook Answers Top Payroll Questions. .................................................................................7

NLRB Issues Final Rule on Joint Employer Status. ............................................................................7

USCIS Reminds Employers to Follow Same Guidelines After Disasters. .......................................................8

IRS Extends Policy to Allow E-Signatures Indefinitely. ........................................................................9

EEOC 2022 EEO-1 Data Collection Due by December 5 ......................................................................9

8th Circuit Finds Rounding Policy Led to Wage Underpayment. ..............................................................9

IRS Updates Tax Gap Estimates for 2020 and 2021. .........................................................................10

DOL Renews Misclassification Agreements. ................................................................................11

GAO Reviews Agencies’ Efforts to Monitor Contractors’ Use of E-Verify ......................................................11

DOJ Reaches Agreement With Employer to Resolve Immigration Violations. ................................................12

IRS Explains How to Withhold Taxes on Restricted Stock Units ..............................................................12

Wage and Hour Roundup. .................................................................................................13

State and Local News. .....................................................................................................15

November 3, 2023 Volume 31 Issue 11

IRS Announces 2024 Retirement Plan Contribution, Benefit Limits

The IRS announced the changes to the dollar limits

on benefits and contributions under qualified

retirement plans, as well as other items, for tax year 2024

[Notice 2023-75, 11-1-23].

IRC §415, which provides for dollar limits on benefits and

contributions under qualified retirement plans, requires that

the IRS annually adjust these limits for cost-of-living changes.

The IRC also requires various other amounts to be adjusted at

the same time and in the same manner as these dollar limits.

• The limitation on the exclusion for elective deferrals

under §402(g)(1) (e.g., §401(k) and §403(b) plans) increases

to $23,000 (from $22,500).

• The limit on annual additions to defined contribution

plans under §415(c)(1)(A) increases to $69,000 (from $66,000).

• The limit on the annual benefit under a defined benefit

plan contained in §415(b)(1)(A) increases to $275,000 (from

$265,000).

• The annual compensation limit under §401(a)(17),

§404(l), §408(k)(3)(C), and §408(k)(6)(D)(ii) increases to

$345,000 (from $330,000).

• The compensation amount under §408(p)(2)(E)

regarding elective deferrals to SIMPLE retirement accounts

increases to $16,000 (from $15,500).

• The limitation under §457(e)(15) concerning elective

deferrals to deferred compensation plans of state and local

governments and tax-exempt organizations (§457(b) plans)

increases to $23,000 (from $22,500).

• The limitation under §416(i)(1)(A)(i) concerning the

definition of “key employee” in a top-heavy plan increases to

$220,000 (from $215,000).

• The limitation under §414(v)(2)(B)(i) for catch-up

contributions to §§401(k), 403(b), and 457(b) plans for

individuals age 50 or over remains $7,500 the limitation under

§414(v)(2)(B)(ii) for catch-up contributions to an employer’s

Inside this issue...

Social Security Wage Base Increases to $168,600 for 2024 ...................................................................2

IRS Releases 2023 ACA Forms and Instructions ..............................................................................2

OCSS Releases Revised IWO and Instructions. ...............................................................................3

IRS Announces Withdrawal Process for ERC Claims. .........................................................................3

State Unemployment Insurance Taxable Wage Bases for 2024. ..............................................................4

FIRE Users Should Check TCCs Now to Make Sure They Are Current. ..........................................................4

USCIS Requests Comments on E-Verify NextGen. ............................................................................5

HHS Raises Civil Penalties for HIPAA Violations, NDNH Misuse ...............................................................5

IRS Updates Progress on Digitalization Efforts. ..............................................................................5

DOL Implements Final Rule for Davis-Bacon Act. ............................................................................6

EFTPS Now Requires Multi-Factor Authentication ...........................................................................6

Daylight Saving Time Ends November 5. ....................................................................................7

USCIS Extends EAD Validity Period to 5 Years for Some Noncitizens ..........................................................7

Free eBook Answers Top Payroll Questions. .................................................................................7

NLRB Issues Final Rule on Joint Employer Status. ............................................................................7

USCIS Reminds Employers to Follow Same Guidelines After Disasters. .......................................................8

IRS Extends Policy to Allow E-Signatures Indefinitely. ........................................................................9

EEOC 2022 EEO-1 Data Collection Due by December 5 ......................................................................9

8th Circuit Finds Rounding Policy Led to Wage Underpayment. ..............................................................9

IRS Updates Tax Gap Estimates for 2020 and 2021. .........................................................................10

DOL Renews Misclassification Agreements. ................................................................................11

GAO Reviews Agencies’ Efforts to Monitor Contractors’ Use of E-Verify ......................................................11

DOJ Reaches Agreement With Employer to Resolve Immigration Violations. ................................................12

IRS Explains How to Withhold Taxes on Restricted Stock Units ..............................................................12

Wage and Hour Roundup. .................................................................................................13

State and Local News. .....................................................................................................15

November 3, 2023 Volume 31 Issue 11

IRS Announces 2024 Retirement Plan Contribution, Benefit Limits

The IRS announced the changes to the dollar limits

on benefits and contributions under qualified

retirement plans, as well as other items, for tax year 2024

[Notice 2023-75, 11-1-23].

IRC §415, which provides for dollar limits on benefits and

contributions under qualified retirement plans, requires that

the IRS annually adjust these limits for cost-of-living changes.

The IRC also requires various other amounts to be adjusted at

the same time and in the same manner as these dollar limits.

• The limitation on the exclusion for elective deferrals

under §402(g)(1) (e.g., §401(k) and §403(b) plans) increases

to $23,000 (from $22,500).

• The limit on annual additions to defined contribution

plans under §415(c)(1)(A) increases to $69,000 (from $66,000).

• The limit on the annual benefit under a defined benefit

plan contained in §415(b)(1)(A) increases to $275,000 (from

$265,000).

• The annual compensation limit under §401(a)(17),

§404(l), §408(k)(3)(C), and §408(k)(6)(D)(ii) increases to

$345,000 (from $330,000).

• The compensation amount under §408(p)(2)(E)

regarding elective deferrals to SIMPLE retirement accounts

increases to $16,000 (from $15,500).

• The limitation under §457(e)(15) concerning elective

deferrals to deferred compensation plans of state and local

governments and tax-exempt organizations (§457(b) plans)

increases to $23,000 (from $22,500).

• The limitation under §416(i)(1)(A)(i) concerning the

definition of “key employee” in a top-heavy plan increases to

$220,000 (from $215,000).

• The limitation under §414(v)(2)(B)(i) for catch-up

contributions to §§401(k), 403(b), and 457(b) plans for

individuals age 50 or over remains $7,500 the limitation under

§414(v)(2)(B)(ii) for catch-up contributions to an employer’s