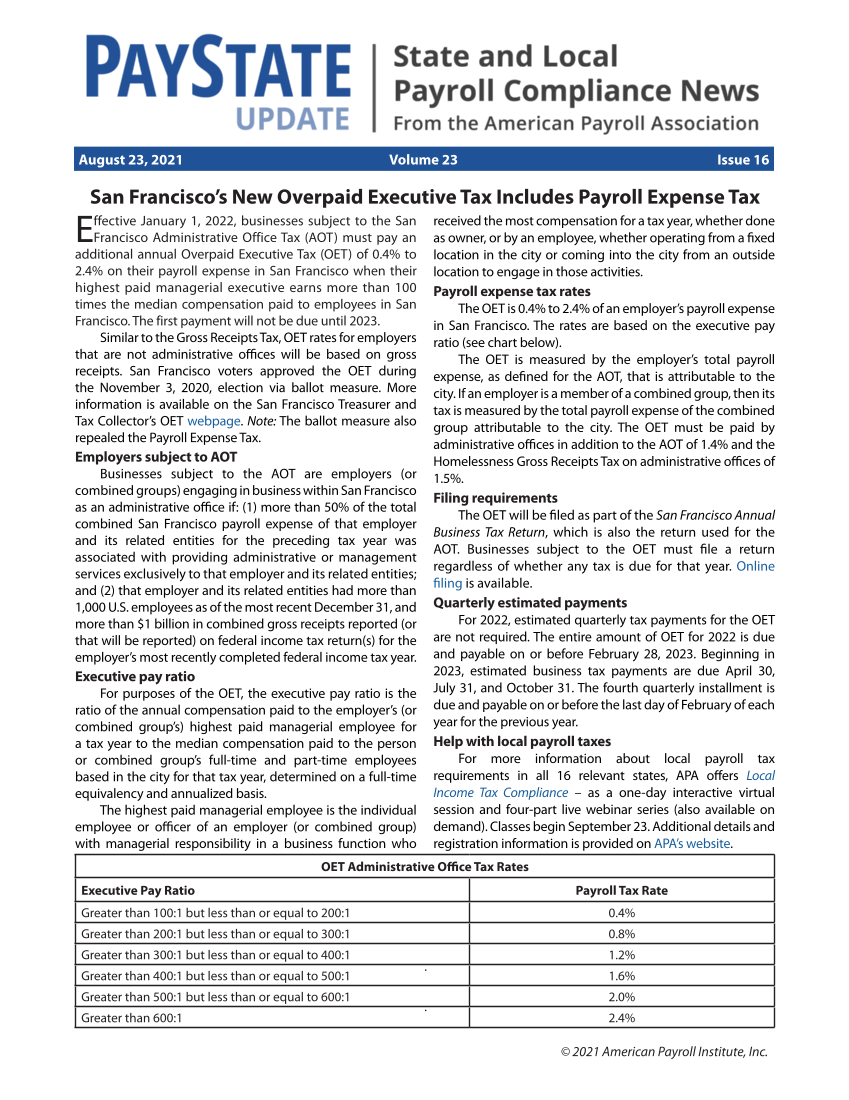

© 2021 American Payroll Institute, Inc. San Francisco’s New Overpaid Executive Tax Includes Payroll Expense Tax Effective January 1, 2022, businesses subject to the San Francisco Administrative Office Tax (AOT) must pay an additional annual Overpaid Executive Tax (OET) of 0.4% to 2.4% on their payroll expense in San Francisco when their highest paid managerial executive earns more than 100 times the median compensation paid to employees in San Francisco. The first payment will not be due until 2023. Similar to the Gross Receipts Tax, OET rates for employers that are not administrative offices will be based on gross receipts. San Francisco voters approved the OET during the November 3, 2020, election via ballot measure. More information is available on the San Francisco Treasurer and Tax Collector’s OET webpage. Note: The ballot measure also repealed the Payroll Expense Tax. Employers subject to AOT Businesses subject to the AOT are employers (or combined groups) engaging in business within San Francisco as an administrative office if: (1) more than 50% of the total combined San Francisco payroll expense of that employer and its related entities for the preceding tax year was associated with providing administrative or management services exclusively to that employer and its related entities and (2) that employer and its related entities had more than 1,000 U.S. employees as of the most recent December 31, and more than $1 billion in combined gross receipts reported (or that will be reported) on federal income tax return(s) for the employer’s most recently completed federal income tax year. Executive pay ratio For purposes of the OET, the executive pay ratio is the ratio of the annual compensation paid to the employer’s (or combined group’s) highest paid managerial employee for a tax year to the median compensation paid to the person or combined group’s full-time and part-time employees based in the city for that tax year, determined on a full-time equivalency and annualized basis. The highest paid managerial employee is the individual employee or officer of an employer (or combined group) with managerial responsibility in a business function who received the most compensation for a tax year, whether done as owner, or by an employee, whether operating from a fixed location in the city or coming into the city from an outside location to engage in those activities. Payroll expense tax rates The OET is 0.4% to 2.4% of an employer’s payroll expense in San Francisco. The rates are based on the executive pay ratio (see chart below). The OET is measured by the employer’s total payroll expense, as defined for the AOT, that is attributable to the city. If an employer is a member of a combined group, then its tax is measured by the total payroll expense of the combined group attributable to the city. The OET must be paid by administrative offices in addition to the AOT of 1.4% and the Homelessness Gross Receipts Tax on administrative offices of 1.5%. Filing requirements The OET will be filed as part of the San Francisco Annual Business Tax Return, which is also the return used for the AOT. Businesses subject to the OET must file a return regardless of whether any tax is due for that year. Online filing is available. Quarterly estimated payments For 2022, estimated quarterly tax payments for the OET are not required. The entire amount of OET for 2022 is due and payable on or before February 28, 2023. Beginning in 2023, estimated business tax payments are due April 30, July 31, and October 31. The fourth quarterly installment is due and payable on or before the last day of February of each year for the previous year. Help with local payroll taxes For more information about local payroll tax requirements in all 16 relevant states, APA offers Local Income Tax Compliance – as a one-day interactive virtual session and four-part live webinar series (also available on demand). Classes begin September 23. Additional details and registration information is provided on APA’s website. OET Administrative Office Tax Rates Executive Pay Ratio Payroll Tax Rate Greater than 100:1 but less than or equal to 200:1 0.4% Greater than 200:1 but less than or equal to 300:1 0.8% Greater than 300:1 but less than or equal to 400:1 1.2% Greater than 400:1 but less than or equal to 500:1 1.6% Greater than 500:1 but less than or equal to 600:1 2.0% Greater than 600:1 2.4% August 23, 2021 Volume 23 Issue 16

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)