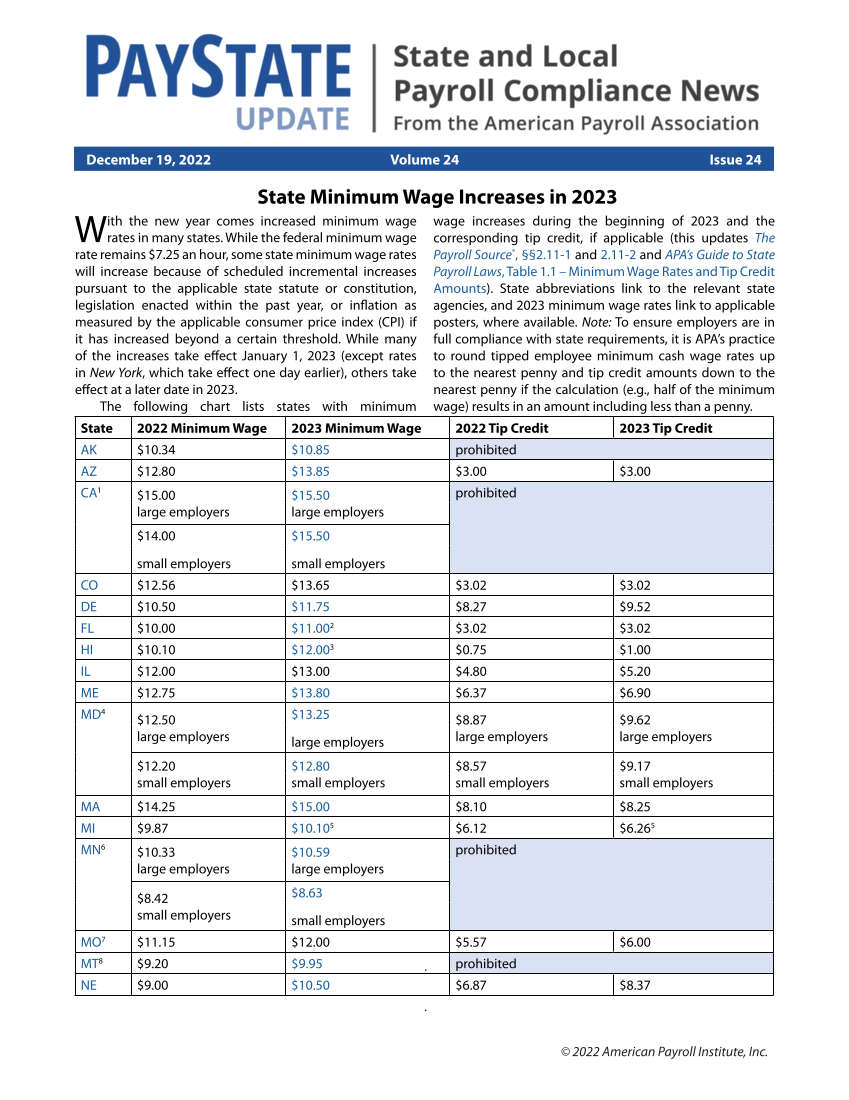

© 2022 American Payroll Institute, Inc. State Minimum Wage Increases in 2023 With the new year comes increased minimum wage rates in many states. While the federal minimum wage rate remains $7.25 an hour, some state minimum wage rates will increase because of scheduled incremental increases pursuant to the applicable state statute or constitution, legislation enacted within the past year, or inflation as measured by the applicable consumer price index (CPI) if it has increased beyond a certain threshold. While many of the increases take effect January 1, 2023 (except rates in New York, which take effect one day earlier), others take effect at a later date in 2023. The following chart lists states with minimum wage increases during the beginning of 2023 and the corresponding tip credit, if applicable (this updates The Payroll Source®, §§2.11-1 and 2.11-2 and APA’s Guide to State Payroll Laws, Table 1.1 – Minimum Wage Rates and Tip Credit Amounts). State abbreviations link to the relevant state agencies, and 2023 minimum wage rates link to applicable posters, where available. Note: To ensure employers are in full compliance with state requirements, it is APA’s practice to round tipped employee minimum cash wage rates up to the nearest penny and tip credit amounts down to the nearest penny if the calculation (e.g., half of the minimum wage) results in an amount including less than a penny. State 2022 Minimum Wage 2023 Minimum Wage 2022 Tip Credit 2023 Tip Credit AK $10.34 $10.85 prohibited AZ $12.80 $13.85 $3.00 $3.00 CA1 $15.00 large employers $15.50 large employers prohibited $14.00 small employers $15.50 small employers CO $12.56 $13.65 $3.02 $3.02 DE $10.50 $11.75 $8.27 $9.52 FL $10.00 $11.002 $3.02 $3.02 HI $10.10 $12.003 $0.75 $1.00 IL $12.00 $13.00 $4.80 $5.20 ME $12.75 $13.80 $6.37 $6.90 MD4 $12.50 large employers $13.25 large employers $8.87 large employers $9.62 large employers $12.20 small employers $12.80 small employers $8.57 small employers $9.17 small employers MA $14.25 $15.00 $8.10 $8.25 MI $9.87 $10.105 $6.12 $6.265 MN6 $10.33 large employers $10.59 large employers prohibited $8.42 small employers $8.63 small employers MO7 $11.15 $12.00 $5.57 $6.00 MT8 $9.20 $9.95 prohibited NE $9.00 $10.50 $6.87 $8.37 December 19, 2022 Volume 24 Issue 24

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)