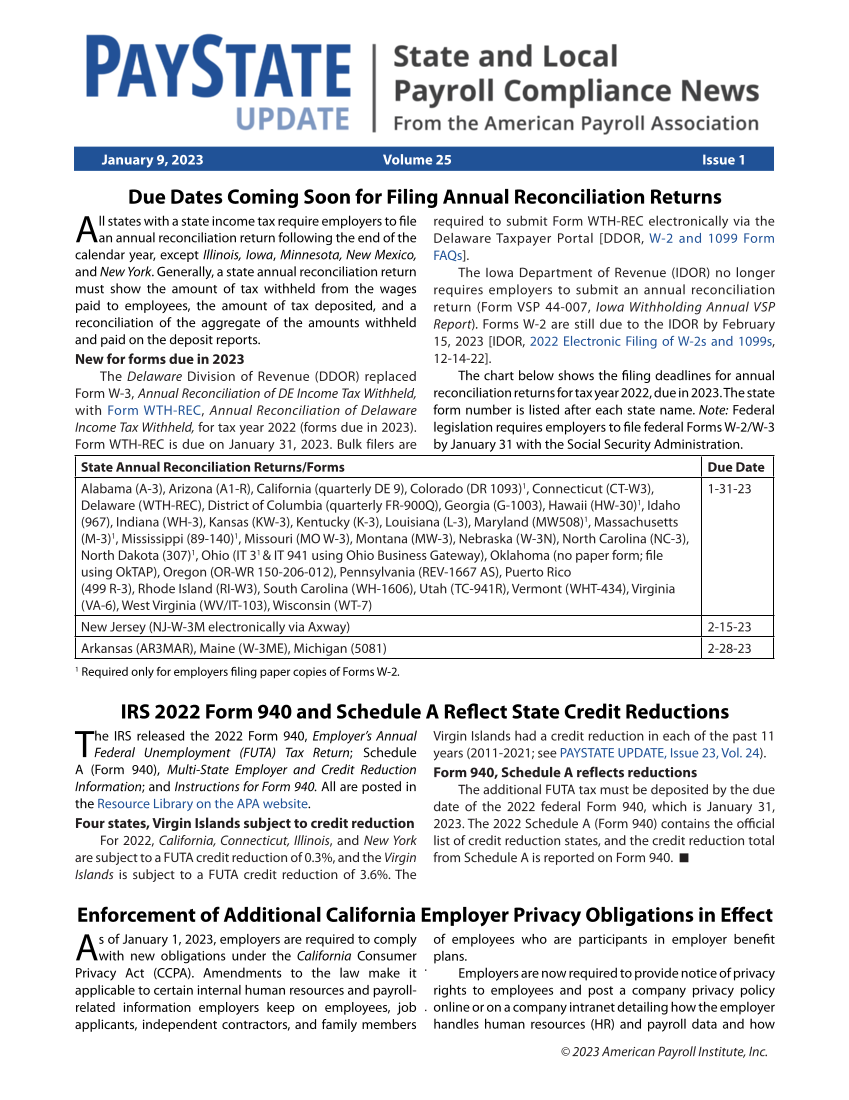

© 2023 American Payroll Institute, Inc. Due Dates Coming Soon for Filing Annual Reconciliation Returns All states with a state income tax require employers to file an annual reconciliation return following the end of the calendar year, except Illinois, Iowa, Minnesota, New Mexico, and New York. Generally, a state annual reconciliation return must show the amount of tax withheld from the wages paid to employees, the amount of tax deposited, and a reconciliation of the aggregate of the amounts withheld and paid on the deposit reports. New for forms due in 2023 The Delaware Division of Revenue (DDOR) replaced Form W-3, Annual Reconciliation of DE Income Tax Withheld, with Form WTH-REC, Annual Reconciliation of Delaware Income Tax Withheld, for tax year 2022 (forms due in 2023). Form WTH-REC is due on January 31, 2023. Bulk filers are required to submit Form WTH-REC electronically via the Delaware Taxpayer Portal [DDOR, W-2 and 1099 Form FAQs]. The Iowa Department of Revenue (IDOR) no longer requires employers to submit an annual reconciliation return (Form VSP 44-007, Iowa Withholding Annual VSP Report). Forms W-2 are still due to the IDOR by February 15, 2023 [IDOR, 2022 Electronic Filing of W-2s and 1099s, 12-14-22]. The chart below shows the filing deadlines for annual reconciliation returns for tax year 2022, due in 2023. The state form number is listed after each state name. Note: Federal legislation requires employers to file federal Forms W-2/W-3 by January 31 with the Social Security Administration. State Annual Reconciliation Returns/Forms Due Date Alabama (A-3), Arizona (A1-R), California (quarterly DE 9), Colorado (DR 1093)1, Connecticut (CT-W3), Delaware (WTH-REC), District of Columbia (quarterly FR-900Q), Georgia (G-1003), Hawaii (HW-30)1, Idaho (967), Indiana (WH-3), Kansas (KW-3), Kentucky (K-3), Louisiana (L-3), Maryland (MW508)1, Massachusetts (M-3)1, Mississippi (89-140)1, Missouri (MO W-3), Montana (MW-3), Nebraska (W-3N), North Carolina (NC-3), North Dakota (307)1, Ohio (IT 31 & IT 941 using Ohio Business Gateway), Oklahoma (no paper form file using OkTAP), Oregon (OR-WR 150-206-012), Pennsylvania (REV-1667 AS), Puerto Rico (499 R-3), Rhode Island (RI-W3), South Carolina (WH-1606), Utah (TC-941R), Vermont (WHT-434), Virginia (VA-6), West Virginia (WV/IT-103), Wisconsin (WT-7) 1-31-23 New Jersey (NJ-W-3M electronically via Axway) 2-15-23 Arkansas (AR3MAR), Maine (W-3ME), Michigan (5081) 2-28-23 1 Required only for employers filing paper copies of Forms W-2. IRS 2022 Form 940 and Schedule A Reflect State Credit Reductions The IRS released the 2022 Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return Schedule A (Form 940), Multi-State Employer and Credit Reduction Information and Instructions for Form 940. All are posted in the Resource Library on the APA website. Four states, Virgin Islands subject to credit reduction For 2022, California, Connecticut, Illinois, and New York are subject to a FUTA credit reduction of 0.3%, and the Virgin Islands is subject to a FUTA credit reduction of 3.6%. The Virgin Islands had a credit reduction in each of the past 11 years (2011-2021 see PAYSTATE UPDATE, Issue 23, Vol. 24). Form 940, Schedule A reflects reductions The additional FUTA tax must be deposited by the due date of the 2022 federal Form 940, which is January 31, 2023. The 2022 Schedule A (Form 940) contains the official list of credit reduction states, and the credit reduction total from Schedule A is reported on Form 940. Enforcement of Additional California Employer Privacy Obligations in Effect As of January 1, 2023, employers are required to comply with new obligations under the California Consumer Privacy Act (CCPA). Amendments to the law make it applicable to certain internal human resources and payroll- related information employers keep on employees, job applicants, independent contractors, and family members of employees who are participants in employer benefit plans. Employers are now required to provide notice of privacy rights to employees and post a company privacy policy online or on a company intranet detailing how the employer handles human resources (HR) and payroll data and how January 9, 2023 Volume 25 Issue 1

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)