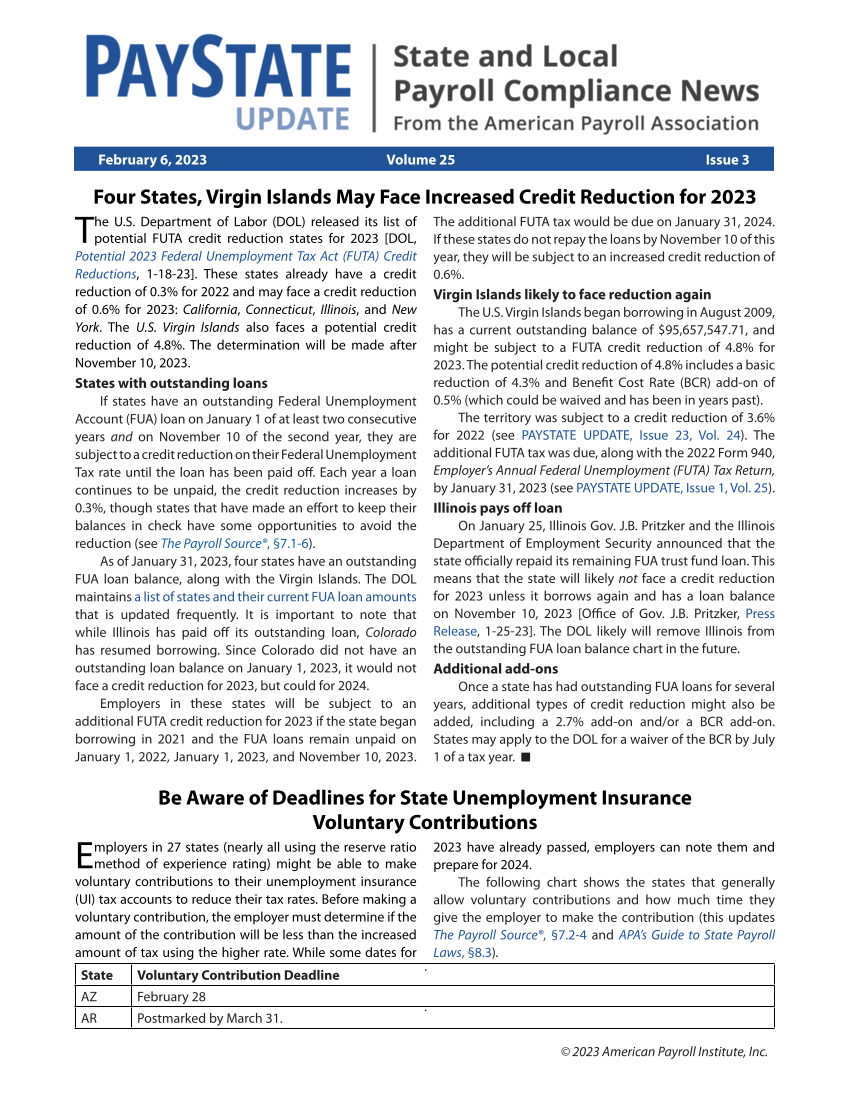

© 2023 American Payroll Institute, Inc. Four States, Virgin Islands May Face Increased Credit Reduction for 2023 The U.S. Department of Labor (DOL) released its list of potential FUTA credit reduction states for 2023 [DOL, Potential 2023 Federal Unemployment Tax Act (FUTA) Credit Reductions, 1-18-23]. These states already have a credit reduction of 0.3% for 2022 and may face a credit reduction of 0.6% for 2023: California, Connecticut, Illinois, and New York. The U.S. Virgin Islands also faces a potential credit reduction of 4.8%. The determination will be made after November 10, 2023. States with outstanding loans If states have an outstanding Federal Unemployment Account (FUA) loan on January 1 of at least two consecutive years and on November 10 of the second year, they are subject to a credit reduction on their Federal Unemployment Tax rate until the loan has been paid off. Each year a loan continues to be unpaid, the credit reduction increases by 0.3%, though states that have made an effort to keep their balances in check have some opportunities to avoid the reduction (see The Payroll Source®, §7.1-6). As of January 31, 2023, four states have an outstanding FUA loan balance, along with the Virgin Islands. The DOL maintains a list of states and their current FUA loan amounts that is updated frequently. It is important to note that while Illinois has paid off its outstanding loan, Colorado has resumed borrowing. Since Colorado did not have an outstanding loan balance on January 1, 2023, it would not face a credit reduction for 2023, but could for 2024. Employers in these states will be subject to an additional FUTA credit reduction for 2023 if the state began borrowing in 2021 and the FUA loans remain unpaid on January 1, 2022, January 1, 2023, and November 10, 2023. The additional FUTA tax would be due on January 31, 2024. If these states do not repay the loans by November 10 of this year, they will be subject to an increased credit reduction of 0.6%. Virgin Islands likely to face reduction again The U.S. Virgin Islands began borrowing in August 2009, has a current outstanding balance of $95,657,547.71, and might be subject to a FUTA credit reduction of 4.8% for 2023. The potential credit reduction of 4.8% includes a basic reduction of 4.3% and Benefit Cost Rate (BCR) add-on of 0.5% (which could be waived and has been in years past). The territory was subject to a credit reduction of 3.6% for 2022 (see PAYSTATE UPDATE, Issue 23, Vol. 24). The additional FUTA tax was due, along with the 2022 Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, by January 31, 2023 (see PAYSTATE UPDATE, Issue 1, Vol. 25). Illinois pays off loan On January 25, Illinois Gov. J.B. Pritzker and the Illinois Department of Employment Security announced that the state officially repaid its remaining FUA trust fund loan. This means that the state will likely not face a credit reduction for 2023 unless it borrows again and has a loan balance on November 10, 2023 [Office of Gov. J.B. Pritzker, Press Release, 1-25-23]. The DOL likely will remove Illinois from the outstanding FUA loan balance chart in the future. Additional add-ons Once a state has had outstanding FUA loans for several years, additional types of credit reduction might also be added, including a 2.7% add-on and/or a BCR add-on. States may apply to the DOL for a waiver of the BCR by July 1 of a tax year. Be Aware of Deadlines for State Unemployment Insurance Voluntary Contributions Employers in 27 states (nearly all using the reserve ratio method of experience rating) might be able to make voluntary contributions to their unemployment insurance (UI) tax accounts to reduce their tax rates. Before making a voluntary contribution, the employer must determine if the amount of the contribution will be less than the increased amount of tax using the higher rate. While some dates for 2023 have already passed, employers can note them and prepare for 2024. The following chart shows the states that generally allow voluntary contributions and how much time they give the employer to make the contribution (this updates The Payroll Source®, §7.2-4 and APA’s Guide to State Payroll Laws, §8.3). State Voluntary Contribution Deadline AZ February 28 AR Postmarked by March 31. February 6, 2023 Volume 25 Issue 3

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)