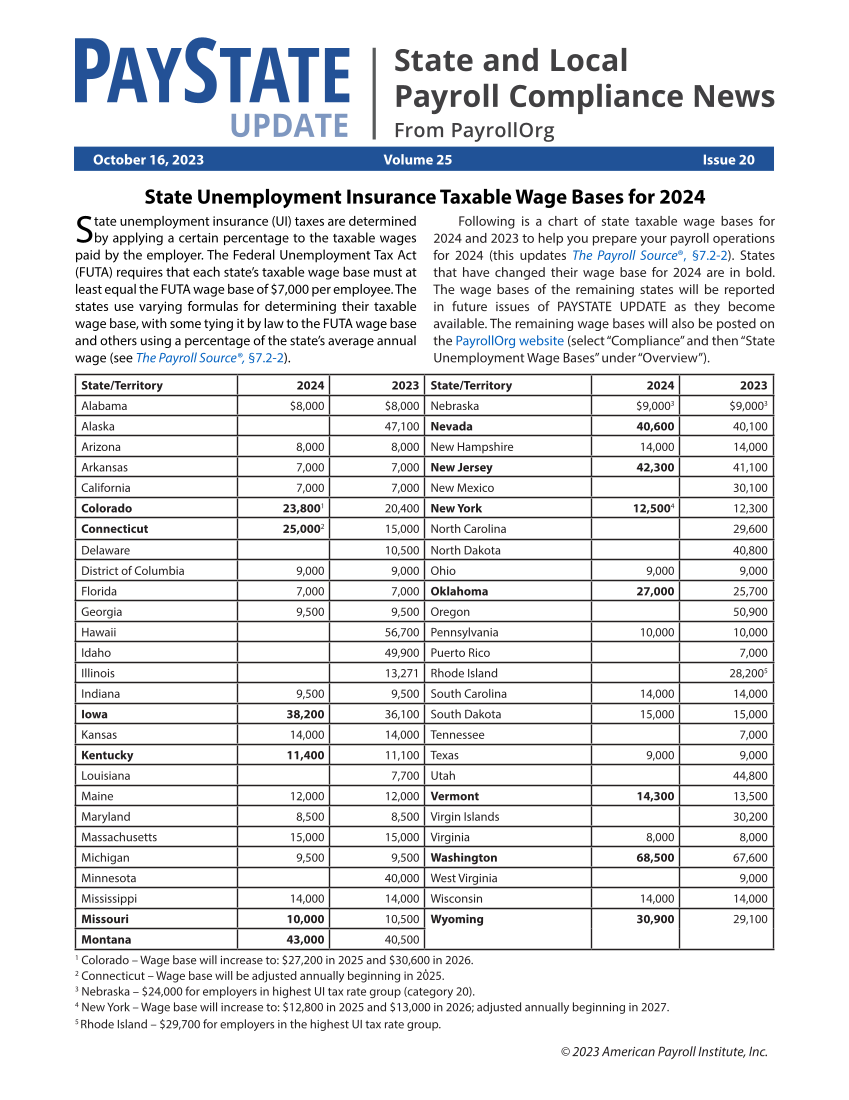

© 2023 American Payroll Institute, Inc. State Unemployment Insurance Taxable Wage Bases for 2024 State unemployment insurance (UI) taxes are determined by applying a certain percentage to the taxable wages paid by the employer. The Federal Unemployment Tax Act (FUTA) requires that each state’s taxable wage base must at least equal the FUTA wage base of $7,000 per employee. The states use varying formulas for determining their taxable wage base, with some tying it by law to the FUTA wage base and others using a percentage of the state’s average annual wage (see The Payroll Source®, §7.2-2). Following is a chart of state taxable wage bases for 2024 and 2023 to help you prepare your payroll operations for 2024 (this updates The Payroll Source®, §7.2-2). States that have changed their wage base for 2024 are in bold. The wage bases of the remaining states will be reported in future issues of PAYSTATE UPDATE as they become available. The remaining wage bases will also be posted on the PayrollOrg website (select “Compliance” and then “State Unemployment Wage Bases” under “Overview”). State/Territory 2024 2023 State/Territory 2024 2023 Alabama $8,000 $8,000 Nebraska $9,0003 $9,0003 Alaska 47,100 Nevada 40,600 40,100 Arizona 8,000 8,000 New Hampshire 14,000 14,000 Arkansas 7,000 7,000 New Jersey 42,300 41,100 California 7,000 7,000 New Mexico 30,100 Colorado 23,8001 20,400 New York 12,5004 12,300 Connecticut 25,0002 15,000 North Carolina 29,600 Delaware 10,500 North Dakota 40,800 District of Columbia 9,000 9,000 Ohio 9,000 9,000 Florida 7,000 7,000 Oklahoma 27,000 25,700 Georgia 9,500 9,500 Oregon 50,900 Hawaii 56,700 Pennsylvania 10,000 10,000 Idaho 49,900 Puerto Rico 7,000 Illinois 13,271 Rhode Island 28,2005 Indiana 9,500 9,500 South Carolina 14,000 14,000 Iowa 38,200 36,100 South Dakota 15,000 15,000 Kansas 14,000 14,000 Tennessee 7,000 Kentucky 11,400 11,100 Texas 9,000 9,000 Louisiana 7,700 Utah 44,800 Maine 12,000 12,000 Vermont 14,300 13,500 Maryland 8,500 8,500 Virgin Islands 30,200 Massachusetts 15,000 15,000 Virginia 8,000 8,000 Michigan 9,500 9,500 Washington 68,500 67,600 Minnesota 40,000 West Virginia 9,000 Mississippi 14,000 14,000 Wisconsin 14,000 14,000 Missouri 10,000 10,500 Wyoming 30,900 29,100 Montana 43,000 40,500 1 Colorado – Wage base will increase to: $27,200 in 2025 and $30,600 in 2026. 2 Connecticut – Wage base will be adjusted annually beginning in 2025. 3 Nebraska – $24,000 for employers in highest UI tax rate group (category 20). 4 New York – Wage base will increase to: $12,800 in 2025 and $13,000 in 2026 adjusted annually beginning in 2027. 5 Rhode Island – $29,700 for employers in the highest UI tax rate group. October 16, 2023 Volume 25 Issue 20

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)